Can a Tax Lawyer Help Negotiate Tax Debt with the IRS?

Resolving tax debt with the IRS can be a challenging process. For many taxpayers, hiring a tax attorney becomes essential when facing substantial tax liabilities or complex issues. A qualified attorney brings expertise, negotiation skills, and legal knowledge to secure the best possible outcome. The Role of a Tax Attorney in IRS Negotiations A tax…

Why Choosing Cruelty-Free Hair Products Matters?

In recent years, consumers have become increasingly aware of the impact their choices have on the environment and animal welfare. The shift toward cruelty-free hair products reflects this growing concern. But why does it matter? This article explores the significance of choosing cruelty-free options and the benefits it offers. Understanding Cruelty-Free Products Cruelty-free hair products…

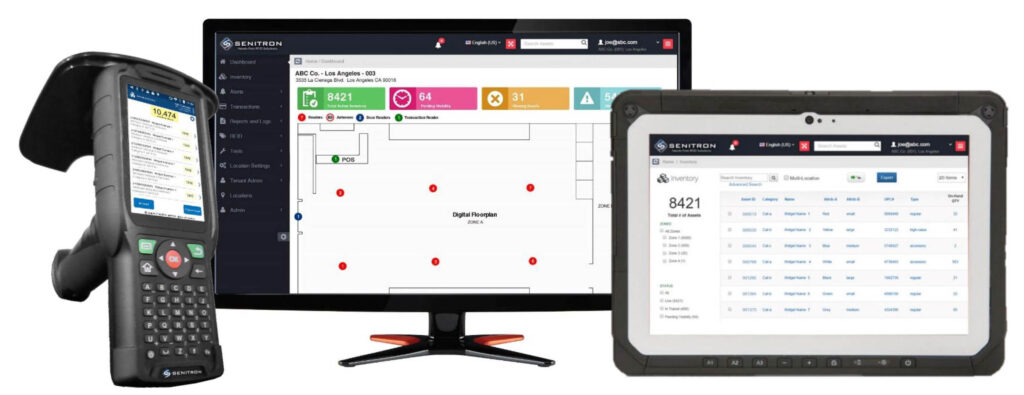

Use of Advanced Technology for Asset Tracking in Retail Shops

When you are running a retail shop, tracking your assets is hugely important. Right now, so many advanced technologies are there that we can use for this cause. Retail tracking is a huge market, and choosing the right tech is essential. In this blog, we will talk about a number of ways that can help…

Understanding Four Common Types of Tax Audits

Tax audits can be stressful and intimidating for many individuals and businesses. Understanding the different types of audits can help demystify the process and prepare for what lies ahead. Each type of audit serves a unique purpose and has specific procedures. Here is an exploration of four common types of tax audits. 1. Correspondence Audit…

The Importance of Ventura Tax Attorneys in Your Business Tax Strategy

Navigating the complexities of business taxes can be challenging. Ventura tax attorneys play a crucial role in developing effective tax strategies for businesses. Their expertise can lead to better financial management and compliance with federal and state regulations. Understanding their role is essential for any business owner looking to optimize their tax strategy. Understanding Tax…

5 Best Practices to Enhance Asset Management for Maximum Efficiency

Effective asset management is essential for businesses aiming to optimize efficiency, reduce costs, and boost productivity. By adopting proven best practices, companies can unlock the full potential of their resources and streamline operations. Here are five strategies to help organizations enhance asset management, improve resource allocation, and support long-term growth. 1. Leverage Data Analytics to…

Capital Gain Tax: Finding Efficient Way to Reduce the Taxes

When a person makes an income in the first phase, only they become liable to pay a certain amount in taxes once they cross the minimum wage earning parameter threshold. Beyond that, one needs to pay a certain amount in taxes, as it’s expected for them to pay at the end of every fiscal year….