IMARC Group, a leading market research company, has recently released a report titled “Business Travel Market Report by Type (Managed Business Travel, Unmanaged Business Travel), Purpose Type (Marketing, Internal Meetings, Trade Shows, Product Launch, and Others), Expenditure (Travel Fare, Lodging, Dining, and Others), Age Group (Travelers Below 40 Years, Travelers Above 40 Years), Service Type (Transportation, Food and Lodging, Recreational Activities, and Others), Travel Type (Group Travel, Solo Travel), End-User (Government, Corporate, and Others), and Region 2025-2033”. The study provides a detailed analysis of the industry, including the global business travel market share, travel, size, and industry trends forecast. The report also includes competitor and regional analysis and highlights the latest advancements in the market.

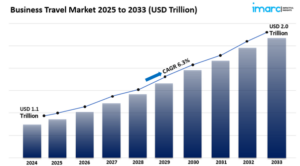

The global business travel market size reached USD 1.1 Trillion in 2024. Looking forward, IMARC Group expects the market to reach USD 2.0 Trillion by 2033, exhibiting a growth rate (CAGR) of 6.3% during 2025-2033.

Request to Get the Sample Report:

https://www.imarcgroup.com/business-travel-market/requestsample

Business Travel Market Trends

The business travel market is set to evolve significantly. It will adapt to new trends and demands. In 2024, recovery from the pandemic will boost travel. Companies will aim to reconnect and collaborate in person. This trend will continue into 2025. Organizations will prioritize travel that meets their goals. Sustainability will be key. Companies will adopt eco-friendly practices to reduce their impact.

Advanced technologies will improve the travel experience. AI and mobile apps will make bookings easier and more personalized. Businesses will seek a mix of in-person and virtual meetings. This will increase the demand for customized travel solutions.

Overall, the market is on the brink of a dynamic change. It will be driven by recovery, sustainability, and technological innovation. Business travel will remain essential.

Market Dynamics 1: Recovery and Resilience Post-Pandemic

The business travel market is bouncing back as companies adapt to post-pandemic conditions. After a sharp drop during COVID-19, many now value in-person meetings. They find them better for collaboration.

We expect strong demand for business travel by 2024. In-person meetings are simply more effective than virtual ones. This trend is strong in finance, tech, and consulting, where networking is key. Companies are raising travel budgets for conferences and trade shows. They see these events as key to boosting innovation and growth. With hybrid work models on the rise, businesses are now planning travel more to cut costs and maximize value.

As they recover, the focus will shift to safety, flexibility, and employee well-being. This will shape travel policies for a more resilient. market.

Market Dynamics 2: Emphasis on Sustainability and Corporate Responsibility

With a rise in interest in corporate responsibility, the business travel market is shifting to sustainability. By 2024, companies will recognize travel’s environmental impact and aim to reduce it. This effort is driven by regulations and the demand for sustainable practices. Organizations are now prioritizing eco-friendly travel. They choose low-emission airlines, use public transport, and select green hotels.

Many also invest in carbon offset programs. This shows their commitment to sustainability, boosting their reputation and employee engagement. Travel management companies are stepping up. They now offer tools to track and manage carbon emissions. With the rise in demand for sustainable travel, eco-friendly options will likely increase. services.

Market Dynamics 3: Technological Advancements in Travel Management

Technology is changing business travel. It’s making trips easier and better. By 2024, AI, machine learning, and mobile apps will revolutionize travel management. AI is already helping companies. It streamlines bookings, improves travel plans, and gives personalized recommendations. Mobile apps are key too.

They provide real-time flight updates, track expenses, and store travel plans. Data analytics helps companies understand travel habits and spending. This way, they can make better decisions, get lower prices, and follow travel rules. As Business travel is changing. To be efficient and grow, we must embrace new technology. It will improve satisfaction, too.

Business Travel Market Report Segmentation:

By Type:

- Managed Business Travel

- Unmanaged Business Travel

Managed business travel represents the largest market segment due to the increasing corporate emphasis on cost-effective and organized travel management solutions.

By Purpose Type:

- Marketing

- Internal Meetings

- Trade Shows

- Product Launch

- Others

Marketing accounts for the majority of the market shares owing to heavy investment in promotional activities and client engagement.

By Expenditure:

- Travel Fare

- Lodging

- Dining

- Others

Travel fare stores lead the market share due to continued reliance on travel agencies for booking convenience and expertise.

By Age Group:

- Travelers Below 40 Years

- Travelers Above 40 Years

Travelers below 40 years constitute the largest market segment since younger professionals comprise a significant portion of business travelers due to career mobility and networking opportunities.

By Service Type:

- Transportation

- Food and Lodging

- Recreational Activities

- Others

The food and lodging sector holds the largest market share due to the need for accommodation and sustenance during business trips.

By Travel Type:

- Group Travel

- Solo Travel

The group travel sector accounted for the largest market share due to the rising preference for collective arrangements to enhance collaboration, team-building, and cost-sharing benefits.

By End Users:

- Government

- Corporate

- Others

The corporate sector represents the biggest end user segment as various corporate policies, meetings, and conferences are boosting the demand for business travel among employees and executives.

Regional Insights:

- North America

- Asia Pacific

- Europe

- Latin America

- Middle East and Africa

Asia Pacific enjoys the leading position in the market due to its rapid economic growth, globalization, and increasing business opportunities.

Competitive Landscape with Key Players:

The competitive landscape of the business travel market size has been studied in the report with the detailed profiles of the key players operating in the market.

Some of These Key Players Include:

- Airbnb Inc.

- American Express Company

- BCD Travel, Booking Holdings Inc.

- Carlson Wagonlit Travel Inc.

- Expedia Group Inc.

- Fareportal Inc.

- Flight Centre Travel Group

- Hogg Robinson Group

- Travel Leaders Group LLC

- Wexas Ltd. etc.

Ask Analyst for Customized Report:

https://www.imarcgroup.com/request?type=report&id=2130&flag=C

Key Highlights of the Report:

- Market Performance (2018-2023)

- Market Outlook (2024-2032)

- Market Trends

- Market Drivers and Success Factors

- Impact of COVID-19

- Value Chain Analysis

If you need specific information that is not currently within the scope of the report, we will provide it to you as a part of the customization.

About Us

IMARC Group is a leading market research company that offers management strategy and market research worldwide. We partner with clients in all sectors and regions to identify their highest-value opportunities, address their most critical challenges, and transform their businesses.

IMARC’s information products include major market, scientific, economic and technological developments for business leaders in pharmaceutical, industrial, and high technology organizations. Market forecasts and industry analysis for biotechnology, advanced materials, pharmaceuticals, food and beverage, travel and tourism, nanotechnology and novel processing methods are at the top of the company’s expertise.

Contact Us:

IMARC Group

134 N 4th St

Brooklyn, NY 11249, USA

Website: imarcgroup.com

Email: [email protected]

Americas: +1-631-791-1145 | Europe & Africa: +44-753-713-2163 | Asia: +91-120-433-0800