Are you encountering payroll errors in QuickBooks desktop and wondering how to fix them? You’re not alone. Payroll errors can be frustrating and time-consuming to resolve, but with the right steps, you can easily rectify them.

In this article, we will guide you through the process of fixing payroll errors in QuickBooks desktop, so you can get back to managing your business efficiently.

Common Payroll Errors in QuickBooks Desktop

Payroll errors can occur due to various reasons, and it’s important to identify the common ones to effectively troubleshoot and resolve them. Here are some of the most frequently encountered payroll errors in QuickBooks desktop:

Incorrect Employee Details:

This error may arise when employee information, such as Social Security numbers, addresses, or names, is entered incorrectly. It can lead to issues with tax calculations and payment processing.

Tax Calculation Discrepancies:

Incorrect calculation of taxes can result in underpayment or overpayment, causing problems with employee compensation and tax filings. This error can occur due to outdated tax tables or incorrect tax settings.

Payment Issues:

Payroll errors related to payments can include bounced checks, failed direct deposits, or incorrect payment amounts. These errors can lead to employee dissatisfaction and legal complications if not resolved promptly.

Understanding the impact of payroll errors is crucial in order to grasp their significance and take appropriate action.

Understanding the Impact of Payroll Errors

Payroll errors can have far-reaching consequences for both your business and your employees. Here’s why it’s essential to address and resolve these errors promptly:

Financial Accuracy:

Accurate payroll processing is crucial for maintaining financial records and ensuring compliance with tax regulations. Payroll errors can result in incorrect financial statements, leading to issues with audits and financial planning.

Employee Satisfaction:

Timely and accurate payment of wages is vital for employee morale and satisfaction. Payroll errors can cause delays or discrepancies in compensation, which can negatively impact employee motivation and trust.

Legal Compliance:

Compliance with employment laws and tax regulations is imperative for any business. Payroll errors can lead to non-compliance, resulting in penalties, fines, and legal complications.

By understanding the impact of payroll errors, you can prioritize their resolution and minimize any potential negative consequences.

Troubleshooting Payroll Errors in QuickBooks Desktop

Before diving into the process of fixing payroll errors in QuickBooks desktop, it’s important to troubleshoot and identify the root causes. Here are some troubleshooting steps to help you diagnose the issue:

Review Employee Information:

Double-check employee details, such as names, addresses, and Social Security numbers, to ensure accuracy. Update any incorrect information in QuickBooks desktop.

Verify Tax Settings:

Check the tax settings in QuickBooks desktop to ensure they align with the current tax regulations. Update any outdated tax tables or settings to reflect the correct calculations.

Review Payment Records:

Scrutinize payment records, including check numbers, direct deposits, and payment amounts, to identify any discrepancies or errors. Rectify any incorrect payment information in QuickBooks desktop.

By troubleshooting the payroll errors, you can pinpoint the specific issues and take the necessary steps to fix them.

Highly recommended: QuickBooks Payroll Update Not Working

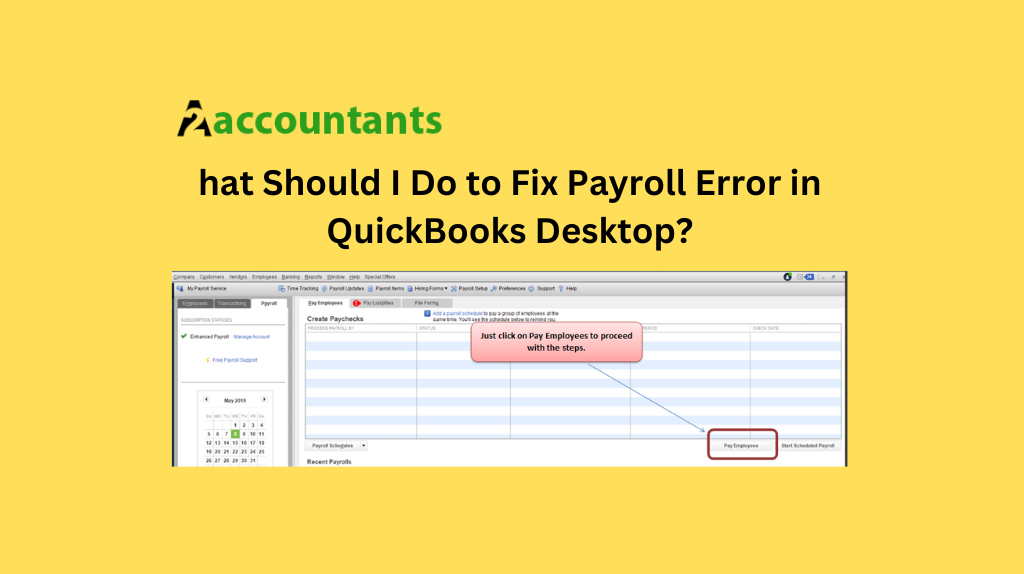

Step-by-Step Guide to Fixing Payroll Errors in QuickBooks Desktop

Now that you have troubleshooter the payroll errors and identified the root causes, it’s time to fix them. Follow this step-by-step guide to rectify the payroll errors in QuickBooks desktop:

Update Employee Information:

Correct any employee details that were found to be incorrect during the troubleshooting process. Ensure accuracy in names, addresses, Social Security numbers, and other relevant information.

Adjust Tax Settings:

Update tax settings in QuickBooks desktop based on the current tax regulations. Ensure that the correct tax rates and calculations are applied to employee wages.

Rectify Payment Records:

Make the necessary adjustments to payment records in QuickBooks desktop to reflect the correct payment amounts, check numbers, or direct deposit details. Double-check the accuracy of the records before finalizing the changes.

By following this step-by-step guide, you can fix the payroll errors in QuickBooks desktop and ensure accurate and timely payments for your employees.

Best Practices for Preventing Payroll Errors

Prevention is better than cure when it comes to payroll errors. Implementing best practices can help you minimize the occurrence of payroll errors in QuickBooks desktop. Here are some tips to prevent payroll errors:

Regularly Update Employee Information:

Keep employee records up to date by routinely verifying and updating their information in QuickBooks desktop. Regularly review and make necessary changes to avoid errors caused by outdated information.

Stay Informed About Tax Regulations:

Stay updated with the latest tax regulations and ensure that your tax settings in QuickBooks desktop are aligned with the current requirements. Regularly check for updates and make any necessary adjustments.

Perform Regular Audits:

Conduct periodic audits of your payroll records to identify and rectify any errors or discrepancies. Review payment records, tax calculations, and employee information to maintain accuracy.

By implementing these best practices, you can minimize the occurrence of payroll errors and streamline your payroll management process.

Seeking Professional Help for Complex Payroll Errors

While many payroll errors can be resolved by following the steps mentioned earlier, some errors may require professional assistance. Complex payroll errors, such as those involving legal implications or intricate tax calculations, may necessitate the expertise of a payroll specialist or an accountant.

If you encounter payroll errors that you are unable to resolve on your own, consider seeking professional help. A payroll specialist can provide guidance, expertise, and additional resources to address the complex issues and ensure accurate payroll processing.

Resources for Further Assistance and Support

If you need further assistance or support in fixing payroll errors in QuickBooks desktop, there are several resources available. Here are some options you can explore:

QuickBooks Support:

Visit the official QuickBooks support website for troubleshooting guides, FAQs, and community forums where you can find answers to common payroll error issues.

Online Tutorials and Guides:

Browse through online tutorials, guides, and video tutorials that provide step-by-step instructions on fixing specific payroll errors in QuickBooks desktop.

Hire a QuickBooks Consultant:

Consider hiring a QuickBooks consultant or expert who can provide personalized assistance and guidance tailored to your specific payroll error situation.

By utilizing these resources, you can access the necessary support and guidance to resolve payroll errors efficiently.

Benefits of Using QuickBooks Desktop for Payroll Management

Despite the occasional payroll errors, QuickBooks desktop remains a popular choice for payroll management among businesses. Here are some benefits of using QuickBooks desktop for your payroll needs:

Comprehensive Payroll Features:

QuickBooks desktop offers a wide range of features, including tax calculations, direct deposit options, and payroll reporting, to simplify and automate your payroll management process.

Integration with Accounting Software:

QuickBooks desktop seamlessly integrates with other accounting software, providing a holistic financial management solution for your business.

User-Friendly Interface:

QuickBooks desktop is known for its user-friendly interface, making it easy for small business owners and non-accounting professionals to navigate and manage their payroll.

By leveraging these benefits, you can efficiently manage your payroll process and minimize the occurrence of errors.

Conclusion

Payroll errors in QuickBooks desktop can be frustrating, but with the right approach, you can fix them effectively.

By understanding the common payroll errors, troubleshooting the issues, and following a step-by-step guide to fix them, you can ensure accurate and timely payments for your employees.

Implementing best practices for preventing payroll errors, seeking professional help when needed, and utilizing resources for assistance and support are essential in maintaining an error-free payroll process.